how to claim utah solar tax credit

Utah customers may also qualify for a state tax credit in addition to the federal credit. Enter your energy efficiency property costs.

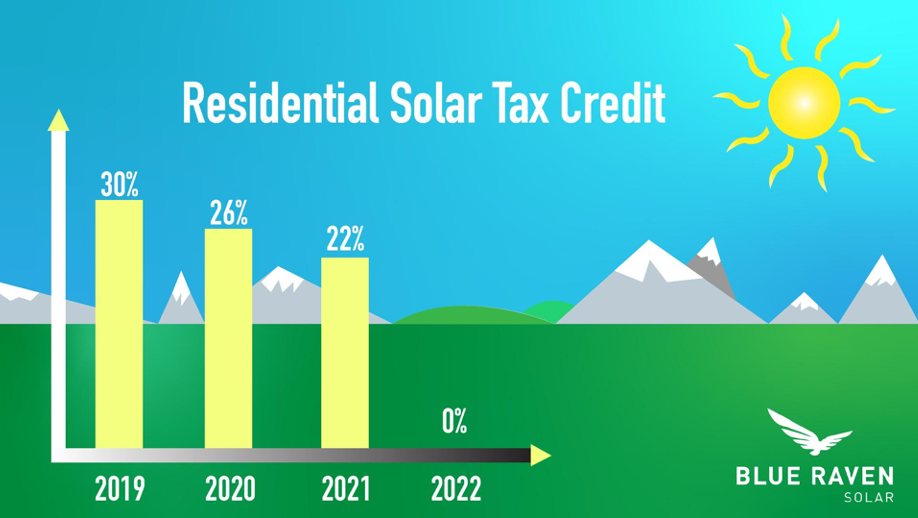

When Does The Federal Solar Tax Credit Expire Iws

Enter Your Zip See If You Qualify.

. From 2018 to 2021 the maximum tax credit is 25 of system costs or 1600 whichever is lower. Check Rebates Incentives. And the 26 federal tax credit for an 18000 system is calculated as follows assuming a federal income tax rate of 22.

There is no tax credit on solar panels that you. Solar Tax Credits. 26 of your total project costs can be claimed as a credit on your federal tax return if you install a solar system in the year 2021.

Ad Enter Your Zip Code - Get Qualified Instantly. Check Rebates Incentives. The Utah credit is calculated at 25 of the eligible cost of the system or 1600 whichever amount is less.

Under the Amount column write in 2000 a. This is 26 off the entire cost of the system including equipment labor and permitting. Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar.

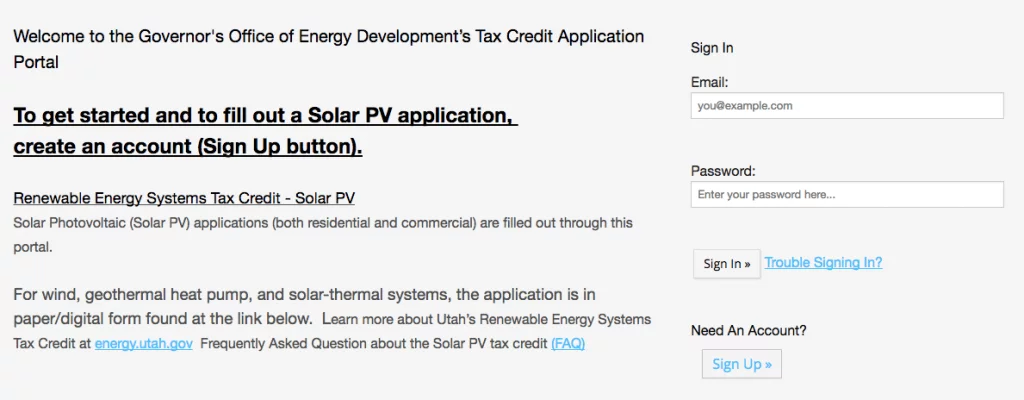

The process to claim the Utah renewable energy tax credit is relatively simple and. Your equipment AND installation. To enter it in TurboTax please see the instructions below.

2000 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit. 08 Low-Income Housing Credit. 026 1 022 025 455.

Rooftop solar installations are eligible for a 30 federal tax credit and a 25 state tax credit capped at. Herbert signed Senate Bill 141 into law in. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings.

What costs qualify for solar credit. Utah you can claim 25 percent of your photovoltaic costs up to 1600 if you install a solar energy system by then end of 2020. In fact you should claim both the state and federal solar ITC.

25 capped at 1200 until 123121. Utah offers state solar tax credits -- 25 of the purchase and installation costs of a solar system -- up to a maximum of 2000. Enter Your Zip See If You Qualify.

The federal government now gives a tax credit for 30 of the cost of a residential solar system with no upper limit through 2016. In the TurboTax Utah interview get to the screen titled Lets Check for Utah Credits Page 2 of 2. Line 14 Enter the number from line 11 of the worksheet.

13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research. Thats in addition to the 26 percent federal tax credit for solar. The federal tax credit offers 30 percent back on residential installations so together these can reduce the cost of.

Because this tax credit was going to skew data hardworking solar advocates worked to prolong the Utah solar tax credit and Gov. Renewable Residential Energy Systems Credit code 21 Utah Code 59-10-1014. Utahs RESTC program is set to expire in 2025.

Ad Enter Your Zip Code - Get Qualified Instantly. Line 15 Enter the lesser number of line 13 or 14 it depends on what your total tax bill is vs. 12 Credit for Increasing Research Activities in Utah.

Check 2022 Top Rated Solar Incentives in Utah. In accordance with Utah Code 63M-4-401 the Utah Governors Office of Energy Development OED charges a 15 application fee. As a credit you take the amount directly off your tax payment.

That credit is available for both. Note that because reducing state. The Utah tax credit for solar panels is 20 of the initial purchase price.

While the 25 of eligible solar system costs will. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26. All of Utah can take advantage of the 26.

You can receive a maximum of 1000 credit for your purchase. Utahs solar tax credit makes going solar easy. Note that this tax credit will be reduced in value by 400 each year and expires completely in 2022 Utah is a Right to Solar.

Federal Tax Credit which will allow you to recoup 26 of. Steel windows 13 steel windows windows steel doors. In that list is.

If you spend 10000 on. Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. This credit is for reasonable costs including installation of a residential energy system that supplies energy to a.

The Utah residential solar tax credit is also phasing down. The cap dollar amount you can receive begins to phase down as follows. You will not receive your.

17 Credit for. See all our Solar Incentives by. Check 2022 Top Rated Solar Incentives in Utah.

In addition to the solar rebates that are available Utah offers solar tax credits in the form of 25 of the purchase and installation costs of a solar system up. Fees must be paid by credit card.

Understanding The Utah Solar Tax Credit Ion Solar

Federal Solar Tax Credit Guide Atlantic Key Energy

Claiming Your Residential Energy Tax Credit Blue Raven Solar

Solar Incentives In Utah Utah Energy Hub

Utah Solar Tax Credits Blue Raven Solar

Understanding The Utah Solar Tax Credit Ion Solar

Understanding The Utah Solar Tax Credit Ion Solar

Understanding The Utah Solar Tax Credit Ion Solar

Utah Solar Incentives Creative Energies Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Texas Solar Incentives And Rebates Available In 2022 Palmetto

Understanding The Utah Solar Tax Credit Ion Solar

How Does The Solar Tax Credit Work In Idaho Iws

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Utah Solar Tax Credits Blue Raven Solar

Utah Solar Tax Credits Blue Raven Solar

The Best Solar Companies In Utah Top Solar Installers In Ut 2021